In this article, I will share with you how to open a new Moniepoint account for free and start making money as a Point of Sales Agent (POS Agent), or as a business owner that you maybe. Look no further, because I got all the details right here!

What is MoniePoint

Moniepoint, an innovative app that allows you to make transactions seamlessly, is the key to unlocking a world of financial opportunities.

In this article, we’ll explore

- how to download the Monie Point app for Android,

- Register your account,

- Become a Monie Point agent

- Start a Monie Point POS business, and

- Even open a Monie Point account for your own business.

Plus, we’ll dive into the charges associated with using Monie Point. Say goodbye to the traditional hassles of handling cash, and say hello to a future of convenience and profit!

Table of Contents

How to Download Moniepoint App for Android

The Moniepoint app is a convenient and easy-to-use mobile application that allows you to access all the features and services offered by Moniepoint.

To download the Moniepoint app for your Android device, follow these simple steps:

Step 1: Go to the Google Play Store

Open the Google Play Store on your Android device. This app comes pre-installed on most Android devices, so you can easily find it in your app drawer or on your home screen.

Step 2: Search for Moniepoint

In the search bar at the top of the Google Play Store, type “Moniepoint” and tap the search icon or press enter. This will display a list of search results related to Monie Point.

Step 3: Select Moniepoint App

From the search results, look for the official Monie Point app. It should be listed as “Monie Point: Mobile Money Agent App.” Tap on the app to open its store page.

Step 4: Install the App

On the Monie Point app store page, you will find an “Install” button. Tap on this button to begin the installation process. The app will start downloading automatically and will be installed on your device once the download is complete.

Step 5: Open the App

After the installation is complete, you can find the Moniepoint app on your home screen or in your app drawer. Tap on the app icon to open it.

Congratulations! You have successfully downloaded the Monie Point app for Android. Now, let’s proceed to the next section on how to register a Moniepoint app.

Related Articles

- Opay Referral Bonus Increases to N800 (See How to Make Free N10,000)

- How to Get Free N10,000 on Alat By Wema Bank for Using Their Mobile App

- How to Make Money on Your Phone on These 3 Apps

How to Register a Moniepoint App

Once you have downloaded the Moniepoint app on your Android device, you need to register an account to start using its services. Follow these steps to register a Moniepoint app:

Step 1: Open the Moniepoint App

Locate the Monie Point app on your Android device and tap on the app icon to open it.

Step 2: Tap on “Register”

On the Monie Point app home screen, you will find a “Register” button. Tap on this button to start the registration process.

Step 3: Fill in Your Information

The registration form will require you to fill in your personal information such as your full name, phone number, email address, and password. Make sure to provide accurate information.

Step 4: Verify Your Phone Number

After filling in your personal information, you will receive an SMS verification code on the phone number you provided. Enter the code in the app to verify your phone number.

Step 5: Set Up Your Security PIN

To ensure the security of your account, you will be asked to set up a security PIN. This PIN will be required for certain transactions within the Monie Point app.

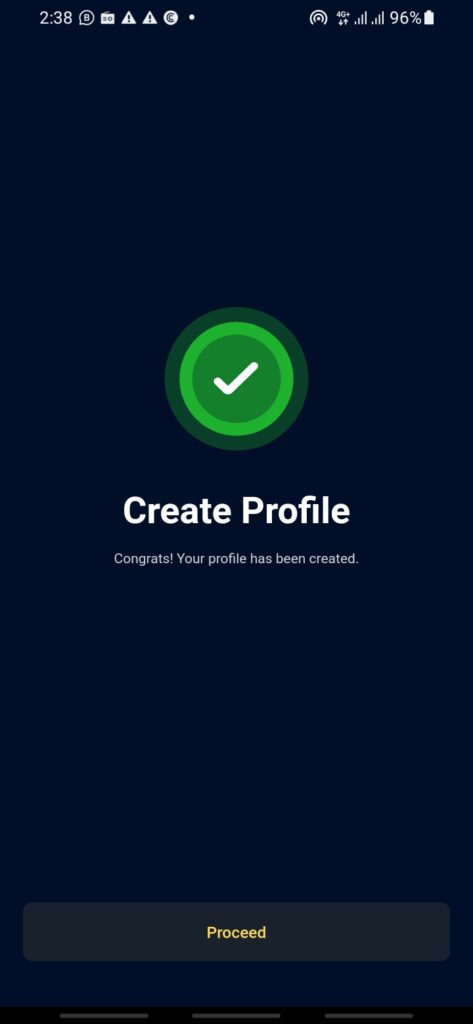

Step 6: Complete Registration

Once you have filled in all the required information and set up your security PIN, tap on the “Complete Registration” button. Your Monie Point account will be created, and you can start using the app.

Congratulations! You are now a registered user of the Monie Point app. In the next section, we will explore how to become a Moniepoint agent login.

How to Become a Moniepoint Agent Login

Becoming a Moniepoint Agent gives you the opportunity to earn money and provide valuable financial services to your community. To become a Moniepoint Agent, follow these steps:

Step 1: Meet the Requirements

Before you can become a Monie Point Agent, you will need to meet certain requirements set by Monie Point. These requirements may include having a valid identification document, a registered business, and a physical location.

Step 2: Contact Moniepoint

Once you have met the requirements, contact Monie Point to express your interest in becoming an agent. Monie Point will provide you with the necessary information and guidance to proceed with the application.

Step 3: Submit Application

Follow the instructions provided by Monie Point to complete your application. This may involve submitting necessary documents and providing additional information about your business.

Step 4: Wait for Approval

After submitting your application, you will need to wait for Monie Point to review and approve your application. This process may take some time, so be patient.

Step 5: Attend Training

If your application is approved, Monie Point will provide you with training and support to ensure that you have the necessary skills and knowledge to operate as a Monie Point Agent.

Step 6: Start Your Moniepoint Agent Journey

Once you have completed the training, you will be ready to start your Moniepoint Agent journey. You will have access to the Monie Point POS Agent app, which allows you to offer various financial services to your customers.

Congratulations! You are now a Monie Point Agent. In the next section, we will discuss how to start MONIEPOINT POS Agent.

How to Start MONIEPOINT POS Agent

As a Monie Point POS Agent, you will have access to a mobile point-of-sale device that allows you to provide various financial services to your customers. Here’s how you can start using the MONIEPOINT POS Agent:

Step 1: Log in to the MONIEPOINT POS Agent App

Download the MONIE POINT POS Agent app from the official Moniepoint website or from the app store of your smartphone. Log in to the app using your Moniepoint Agent credentials.

Step 2: Connect the POS Device

Once you have logged in to the app, connect the POS device to your smartphone or tablet using the provided cable or Bluetooth connection.

Step 3: Power On the POS Device

Press and hold the power button on the Monie Point POS device to turn it on. Wait for the device to boot up.

Step 4: Access Services Menu

On the MONIE POINT POS Agent app, you will find a menu that offers various financial services such as cash withdrawals, deposits, mobile airtime top-ups, bill payments, and more. Select the service you want to provide to your customers.

Step 5: Perform Transactions

Follow the prompts on the MONIE POINT POS Agent app and POS device to perform transactions for your customers. Enter the necessary information and confirm the transaction.

Step 6: Provide Receipt

After completing the transaction, provide a receipt to your customer for their reference. Make sure to inform them about any applicable fees or charges.

Congratulations! You are now ready to start using the MONIE POINT POS Agent and offer financial services to your customers. In the next section, we will discuss how to open a Moniepoint account for your business.

How to Open a Moniepoint Account for Your Business

Opening a Monie Point account for your business allows you to receive payments, track transactions, and manage your finances more efficiently. Follow these steps to open a Monie Point account for your business:

Step 1: Gather Required Documents

Before you can open a Monie Point account for your business, you will need to gather certain documents. These may include your business registration certificate, identification documents, and proof of address.

Step 2: Contact Moniepoint Business Support

Reach out to Monie Point’s business support team to express your interest in opening a business account. They will guide you through the process and provide you with the necessary information.

Step 3: Submit Required Documents

Provide Monie Point with the required documents for your business account. This may involve submitting scanned copies or visiting a Moniepoint branch in person.

Step 4: Wait for Account Approval

After submitting the required documents, you will need to wait for Monie Point to review and approve your business account application. This process may take some time, so be patient.

Step 5: Receive Account Details

Once your business account is approved, you will receive your account details from Monie Point. This will include your account number, login credentials, and any other relevant information.

Step 6: Start Managing Your Business Finances

Using the Monie Point business account, you can now start accepting payments, track transactions, and manage your business finances more efficiently. Explore the features offered by Monie Point to make the most out of your business account.

Congratulations! You have successfully opened a Monie Point account for your business. In the next section, we will discuss how much Moniepoint charges for its services.

How much does Moniepoint Charge

Monie Point charges are transparent and competitive, ensuring that both users and agents get value for their money. Here are the main charges imposed by Monie Point:

Transaction Fees

Moniepoint charges a small fee for every transaction conducted through its platform. The exact transaction fees vary depending on the type of transaction and the amount involved. However, the fees are designed to be affordable and fair.

Agent Commission

As a Monie Point agent, you can earn a commission for every transaction you process on behalf of your customers. This commission varies depending on the type of transaction and the volume of business you generate. The more transactions you process, the higher your commission will be.

Other Services Fees

Monie Point may charge additional fees for certain services such as bill payments, airtime top-ups, and other value-added services. These fees are clearly stated and are designed to cover the costs associated with providing those services.

It is important to note that the specific charges may vary over time, so it is always recommended to stay updated with the latest fee schedule provided by Monie Point.

In the next section, we will explore some of the key features of the Moniepoint app.

Features of the Moniepoint App

The Monie Point app offers a range of features that make it a versatile and convenient tool for both users and agents. Here are some of the key features of the Monie Point app:

1. Easy Money Transfer

With the Monie Point app, you can easily send and receive money to and from anyone within the Monie Point network. The app provides a seamless and secure platform for hassle-free money transfers.

2. Bill Payments

The Moniepoint app allows you to conveniently pay your bills without having to visit multiple service providers or stand in long queues. Simply enter the necessary details and make the payment directly from the app.

3. Airtime Top-Ups

You can recharge your mobile airtime or that of your loved ones directly from the Moniepoint app. This feature is particularly useful when you are running low on airtime and need a quick top-up.

4. Transaction History

The Moniepoint app keeps a record of all your transactions, allowing you to easily track your financial activities. This feature is especially helpful for budgeting and financial management.

5. Agent Services

For Moniepoint agents, the app provides access to a range of agent services such as cash withdrawals, deposits, and other financial transactions. The app serves as a portable point-of-sale device, enabling agents to offer their services on the go.

These are just a few of the many features offered by the Moniepoint app. The app is continuously updated and improved to provide users and agents with a seamless and efficient experience.

In the next section, we will discuss the benefits of opening a Moniepoint account.

Benefits of Opening a Moniepoint Account

Moniepoint Business provides businesses with access to banking solutions that enable them to accept online and offline payments, own bank accounts in their business names and qualify for business loans. More than 1.3 million business customers trust Moniepoint to help them achieve their business goals

Key Features:

1: Bank account in your business name:

Now, you can get a bank account in your business name right from your phone.

2: Send and receive money:

Send money to business partners effortlessly. There are no hidden charges and you have complete control over your account, ensuring your funds reach their intended recipients quickly and securely.

3: POS terminals:

Receive card and bank transfer payments easily with the Moniepoint POS. Request for a POS terminal right from the app and have it delivered to your doorstep within 48 hours.

4: Expense card:

Moniepoint’s expense card helps you manage your business expenses more efficiently. With our expense card, you can track your spending in real time, set spending limits, and create budgets to know if you’re staying on track.

5: Working capital loans:

Moniepoint offers working capital loans for businesses. Our business loans are easy to qualify for and can be used for a variety of purposes such as inventory, expansion, or payroll. Apply in as little as 5 minutes and get an instant decision on loan approval. Our online loan application is available 24/7!

How to Deposit Money into Your Moniepoint Account

To deposit money into your Moniepoint account, follow these steps:

Step 1: Locate a Moniepoint Agent

Find a Moniepoint agent near you. You can use the Moniepoint app or website to locate the nearest agent or ask Moniepoint customer support for assistance.

Step 2: Visit the Agent

Visit the Moniepoint agent with the cash you want to deposit into your account. Make sure to have your Moniepoint account details and identification documents ready.

Step 3: Provide Account Details

Inform the Moniepoint agent that you want to deposit money into your account. Provide them with your Moniepoint account number and any other necessary details.

Step 4: Hand Over the Cash

Hand over the cash to the Moniepoint agent. They will process the transaction and deposit the money into your Moniepoint account.

Step 5: Receive Confirmation

Once the transaction is completed, the Monie Point agent will provide you with a confirmation receipt for the deposit. Keep this receipt for your records.

Congratulations! You have successfully deposited money into your Monie Point account. You can now use the funds for various transactions and services.

Conclusion

Opening a MoniePoint account and using the Monie Point app provides you with a range of financial services and benefits. Whether you are an individual looking for a convenient way to manage your finances or a business owner seeking to offer financial services to your customers, Monie Point has you covered.

In this article, we have covered various aspects of the Monie Point app, including how to download the app, register an account, become a Monie Point Agent, start using the MONIE POINT POS Agent, and open a Monie Point account for your business. We have also discussed the charges imposed by Monie Point, the features offered by the Monie Point app, the benefits of opening a Monie Point account, and how to deposit money into your Monie Point account.

With this comprehensive guide, you are now equipped to embark on your Monie Point journey. So what are you waiting for? Download the Monie Point app, register an account, and start enjoying the benefits of Monie Point today!

For Monie Point Customer Care

contact at [email protected]

Call Monie Point on +23418889990

Twitter now X @moniepointng

Instagram Moniepoint Nigeria

Facebook Moniepoint

WhatsApp +2349088430803

If you get any value in this article please consider sharing it with your friends and family on social media platforms. This will go a long way to help some other people.

Do you know that your shares and likes of this article will motivate us to serve you better in our next article? Please help us to spread this article to your loved ones.