The CBN Reopen COVID-19 Loan portal for the second batch COVID-19 Loan. Meanwhile, you can get up-to N25 Million COVID-19 loan in this stimulus package introduced to support households and Micro, Small, and Medium Enterprises (MSMEs) affected by the COVID19 pandemic. It was stopped a few months ago, but now it has been restored.

Meanwhile, just a few weeks ago the shortlist was also said to be released for the Nigerian Youth Investment Fund of about N166 Million. This second batch COVID-19 Loan application is mainly for:

- The Household,

- Micro Enterprises,

- SMEs, and

- Nigerian youths that did not apply before.

However, if for one reason or the other you did not apply or you apply, but it was not successful, this is the opportunity to re-apply again before it is too late.

Table of Contents

How to Apply for CBN Reopen COVID-19 Loan

Part of the requirements for SME on the CBN Reopen COVID-19 Loan are:

- Registered Business with CAC and

- BVN

Not all business is qualified, meanwhile, below are some of the acceptable types of Business For SME’s for the CBN Reopen COVID-19 Loan

- Agricultural value chain activities,

- Manufacturing & Cottage Industries,

- Artisans,

- Services,

- Trade and general commerce,

- Renewable energy or energy-efficient products and technologies, and

- Any other income-generating projects as may be prescribed by the CBN.

How to Apply for the CBN Reopen COVID-19 Loan

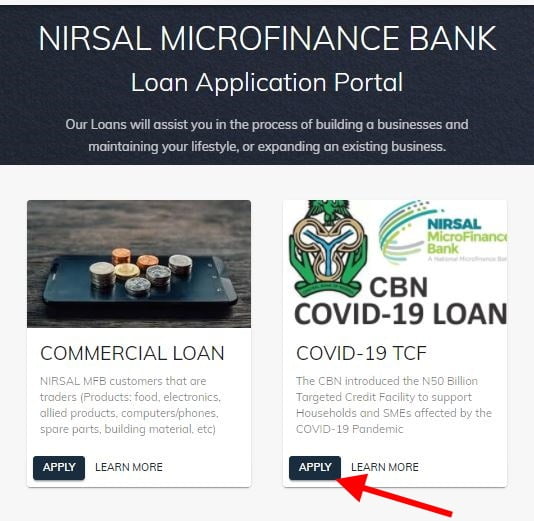

To apply for the CBN Reopen COVID-19 Loan, you first need to go to the Nirsal site or you can as well apply from their site link below

- Once it opens, click on the Apply button under the COVID-19 TCF.

- Select “Household Loan” or “SME Loan” depending on your choice.

- The next step, choose New if you are just applying

- Copy your Reference Number generated

- Enter your BVN and it will automatically update your details. Carefully fill in the rest of the details and click on the Next button.

Upon successful registration, you should get a success message.

NIRSAL Microfinance Bank (NMFB) we review your application and forward the application to the CBN for final approval.

Note that CBN reviews applications and gives final approval for disbursement to NMFB.

Loan Limit

There are different criteria used to determine the loan amount that is disbursed to different eligible participants and segments. They are:

- SMEs- The loan amount shall be determined based on the activity, cash flow, and industry/segment size of beneficiary subject to a maximum of N25 million for SMEs

- Households- They can access a maximum of N3 million. Working capital shall be a maximum of 25% of the average of the previous 3 years’ annual turnover. But where the enterprise is not up to 3 years in operation, 25% of the previous year’s turnover will suffice.

The portal is currently open, so be fast in applying. Also, share this important post to your friends and family as it will be useful to all.

Use the social media platform button below to this post to your love ones.

Meanwhile, just a few weeks ago the shortlist was also said to be released for the Nigerian Youth Investment Fund of about N166 Million. This second batch COVID-19 Loan application is mainly for:

- The Household,

- Micro Enterprises,

- SMEs, and

- Nigerian youths that did not apply before.

However, if for one reason or the other you did not apply or you apply, but it was not successful, this is the opportunity to re-apply again before it is too late.

How to Apply for CBN Reopen COVID-19 Loan

Part of the requirements for SME on the CBN Reopen COVID-19 Loan are:

- Registered Business with CAC and

- BVN

Not all business is qualified, meanwhile, below are some of the acceptable types of Business For SME’s for the CBN Reopen COVID-19 Loan

- Agricultural value chain activities,

- Manufacturing & Cottage Industries,

- Artisans,

- Services,

- Trade and general commerce,

- Renewable energy or energy-efficient products and technologies, and

- Any other income-generating projects as may be prescribed by the CBN.

How to Apply for the CBN Reopen COVID-19 Loan

To apply for the CBN Reopen COVID-19 Loan, you first need to go to the Nirsal site or you can as well apply from their site link below

- Once it opens, click on the Apply button under the COVID-19 TCF.

- Select “Household Loan” or “SME Loan” depending on your choice.

- The next step, choose New if you are just applying

- Copy your Reference Number generated

- Enter your BVN and it will automatically update your details. Carefully fill in the rest of the details and click on the Next button.

Upon successful registration, you should get a success message.

NIRSAL Microfinance Bank (NMFB) we review your application and forward the application to the CBN for final approval.

Note that CBN reviews applications and gives final approval for disbursement to NMFB.

Loan Limit

There are different criteria used to determine the loan amount that is disbursed to different eligible participants and segments. They are:

- SMEs- The loan amount shall be determined based on the activity, cash flow and industry/segment size of beneficiary subject to a maximum of N25 million for SMEs

- Households- They can access a maximum of N3 million. Working capital shall be a maximum of 25% of the average of the previous 3 years’ annual turnover. But where the enterprise is not up to 3 years in operation, 25% of the previous year’s turnover will suffice.

The portal is currently open, so be fast in applying. Also, share this important post to your friends and family as it will be useful to all.

Use the social media platform button below to this post to your love ones.