On October 3, Grayscale Investments officially launched a new investment trust focused on the Aave platform, offering an exciting opportunity for investors to gain exposure to one of the most prominent DeFi (Decentralized Finance) projects today.

Grayscale Launches Aave (AAVE) Investment Trust

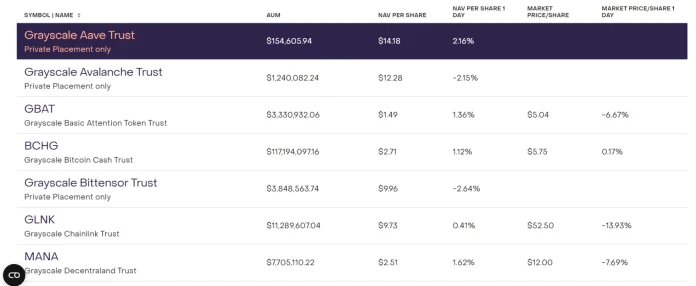

The Grayscale Aave Trust is the latest addition to Grayscale’s portfolio of cryptocurrency investment products. This move follows the company’s trend set in August when it introduced three investment trusts for projects like Sky (formerly MakerDAO), Bittensor, and Sui.

Aave, a leading DeFi platform with nearly $12 billion in total value locked (TVL), caught Grayscale’s attention due to its transparent and decentralized lending and borrowing model based on smart contract technology.

Rayhaneh Sharif-Askary, Grayscale’s Head of Product and Research, emphasized:

By leveraging blockchain and smart contract technology, Aave’s decentralized platform aims to optimize lending and borrowing activities, eliminating intermediaries and reducing reliance on human judgment.

Grayscale, with approximately $21 billion in assets under management as of October 2, is well-known for its Bitcoin and Ethereum ETFs. However, the company continues to diversify its portfolio, offering individual trusts for other protocol tokens such as Basic Attention Token (BAT) and Chainlink (LINK).

Notably, the AAVE token has surged over 135% in the past 12 months, reflecting strong growth and investor confidence in the project. Recently, the Aave community approved a tokenomics upgrade, which will allocate a portion of the protocol’s revenue to AAVE stakers, providing further incentives for holding the token.

Price AAVE

Related: Grayscale Launches Investment Fund for AVAX

AZC.News